Allianz SE, Europe’s biggest insurer, said third-quarter profit rose 36 percent, helped by higher earnings at the life and health insurance unit. The shares rose.

Net income increased to 1.86 billion euros ($2.03 billion) from 1.36 billion euros in the year-earlier quarter, the Munich-based company said in a statement on Friday. That beat the 1.59 billion-euro average of 10 estimates compiled by Bloomberg. Pacific Investment Management Co. had its first quarterly net inflows in three years, with clients adding 4.7 billion euros in third-party assets.

“Allianz made a significant step towards achieving its 2018 targets,” Thomas Seidl, an analyst at Sanford C. Bernstein, wrote in a note to clients.

Allianz rose 3.3 percent to 153.70 euros by 9:08 a.m. in Frankfurt trading, paring declines this year to 6 percent. The Bloomberg Europe 500 Insurance Index declined 9.5 percent over the same time.

Baete’s Targets

Allianz confirmed a target for full-year operating profit of 10 billion euros to 11 billion euros. Operating profit at the life- and health-insurance division advanced 53 percent to 1.13 billion euros, mainly due to higher investment margins in the U.S. and France, Allianz said.

“Efforts to develop our business in a very difficult environment are paying off,” Chief Financial Officer Dieter Wemmer said in the statement.

Baete a year ago also set a goal to raise the return on equity for all of the divisions at Allianz’s life and health unit to at least 10 percent. He is also seeking to achieve annual earnings-per-share growth of 5 percent on average and an adjusted return on equity of 13 percent by 2018.

He has agreed to sell part of Allianz’s life insurance portfolio in Taiwan and the insurer’s operations in South Korea as part of his push to focus on the most profitable businesses and release capital from ones that make less money.

Baete in March appointed Guenther Thallinger head of investment management and global life and health, and named Jacqueline Hunt to lead Allianz’s asset-management and U.S. life-insurance divisions. Pimco, which has been plagued by client withdrawals since the departure of Bill Gross, hired a new CEO with Emmanuel Roman in July.

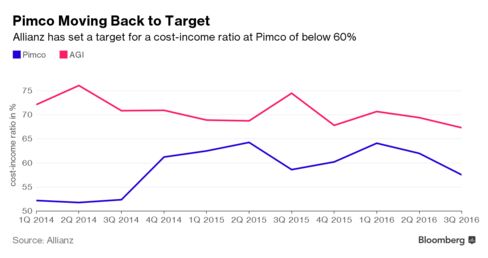

Operating profit at Pimco declined to 455 million euros in the quarter from 500 million euros a year ago, Allianz said in a presentation on its website. Pimco’s cost-income ratio improved to 57.5 percent in the quarter from 58.6 percent a year earlier. That compares with a target of below 60 percent that Allianz has set for this year.

At Allianz Global Investors, the insurer’s other asset manager, profit rose to 154 million euros from 111 million euros. The unit attracted 1.5 billion euros in net new money, the fourteenth quarter of inflows out of fifteen. The cost-income ratio fell to 67.3 percent from 74.5 percent.

To help reach its targets, Allianz could announce a share buyback later this year, analysts including Sanford C. Bernstein’s Seidl have said. Allianz hasn’t bought back its own stock before, using dividends instead to return excess capital to shareholders.

The company is facing a deadline at the end of the year to pay out its unused budget for acquisitions. Wemmer said Friday that budget is currently at about 2.5 billion euros.

Source: Bloomberg