The volatility wrought by the U.K.’s coming vote on European Union membership is something to be embraced.

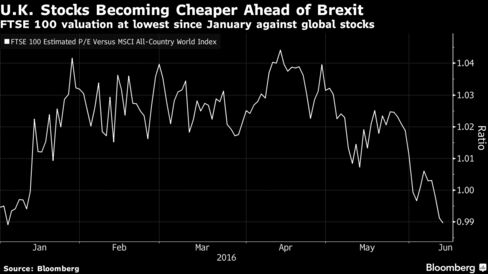

So says Allianz Global Investors’ Harald Sporleder. He is betting the shares, which have outperformed their European peers this year, will keep rewarding investors, and sees the uncertainty surrounding the outcome of the June 23 referendum as an opportunity to boost his holdings. Even if the “Leave” campaign wins — a result forecast to trigger stock volatility — company fundamentals will remain the same, he said. While the FTSE 100 Index is down 3.4 percent so far this month, the Stoxx Europe 600 Index has declined almost twice as much.

“We’re adding U.K. stocks ahead of the referendum, focusing on large caps,” Sporleder, who oversees five European equity funds worth a total $2 billion, said in a June 8 interview in Madrid. “Let’s assume they want to leave. That will be a disaster for U.K. and European markets in general over a couple of days. We would like to use this heightened volatility as an opportunity to buy stocks” as they reach a bottom.

With nine days to go until Britons vote, polls show the race is too close to call. Until last week, U.K. shares remained relatively calm even as top officials from Bank of England Governor Mark Carney to Prime Minister David Cameron warned of the economic damage that an exit would cause. A gauge of volatility on the FTSE 100 yesterday capped its biggest three-day gain in six months. European equities could lose about a quarter of their value in the immediate aftermath of a U.K. secession, a study from risk-modeling firm Axioma Inc. showed.

The probability of the U.K. remaining is still more than 69 percent, according to Oddschecker and Number Cruncher data, while recent polls by ICM, ORB/Independent and YouGov Plc showed the “Leave” campaign leading.