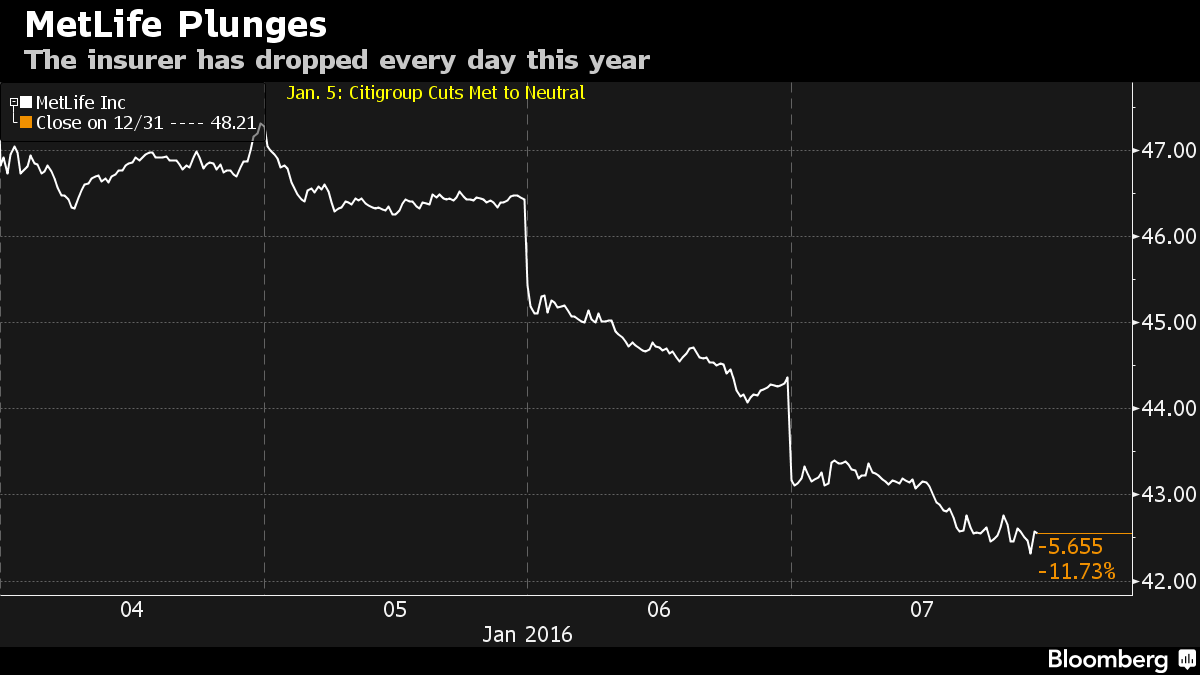

MetLife Inc. has plunged 12 percent in the first week of the year, leading a slump in insurers as a decline in broader equity markets squeeze results from retirement operations, and lower bond yields limit income from the fixed-income portfolio.

MetLife, the largest U.S. life insurer, has posted the second-biggest slide this year in the 88-company Standard & Poor’s 500 Financials Index, beating only Affiliated Managers Group Inc. Rival insurers Prudential Financial Inc. and Lincoln National Corp. have each dropped more than 9 percent since Dec. 31.

The slump adds to pressure on Chief Executive Officer Steve Kandarian who is seeking to improve performance after MetLife dropped 11 percent in 2015 and was flat the year before that.

Source Bloomberg