Zurich Insurance Group AG fell to the lowest in more than three years after Switzerland’s biggest insurer put shareholders on notice that it expects a second straight quarterly loss in its non-life business.

Operating losses in the general insurance unit will probably amount to about $100 million for the last three months of 2015, the company said in a statement Wednesday. That reflects an estimated $275 million in claims from three storms that flooded thousands of homes in northern England, Scotland and Ireland in December.

The disaster came at a difficult time for Zurich, one of the world’s largest insurance companies with some 55,000 employees. The company is searching for a successor to Martin Senn, who resigned as chief executive officer after the non-life unit

posted a third-quarter loss of $183 million. That forced Zurich to abandon a high-profile takeover bid for RSA Insurance Plc. and prompted an overhaul of general insurance.

Zurich plans to speed up cost cuts and wants to exceed its 2016 target of $300 million in savings, according to the statement. The company will book $475 million in charges related to those measures, mainly within general insurance.

“Expectations for the fourth quarter were rather low because of ongoing restructuring at the general insurance unit,” said Daniel Bischof, an analyst at Baader Helvea who recommends buying Zurich’s shares. “The extent of the hit they took is nevertheless disappointing, and it remains to be seen whether this was a final clean-up or more needs to be done to fix the unit.”

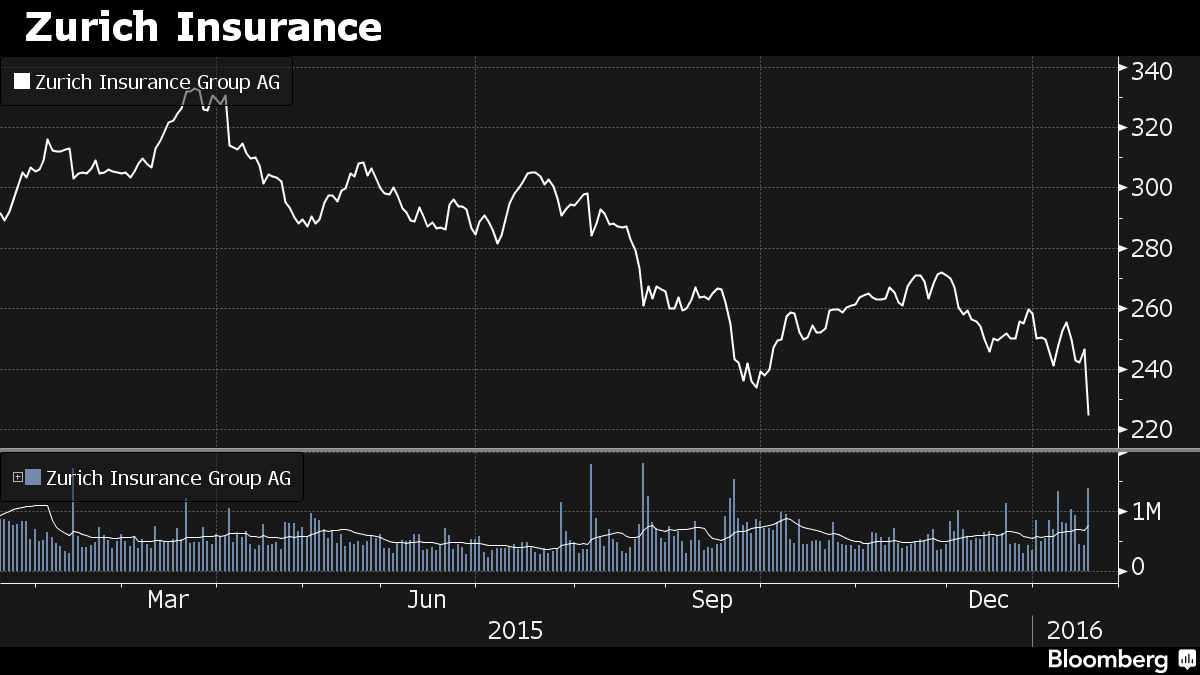

Zurich fell as much as 9 percent to 224.2 francs, the lowest since November 2012. The stock was trading 9 percent lower as of 12:38 p.m. after declining 23 percent over the 12 months through Tuesday…Read more at Bloomberg